Author: Zeng Lu

Can international financial institutions such as the World Bank and the International Monetary Fund effectively respond to increasingly complex global challenges? What progress has been made by the stakeholders in promoting the reform of international financial institutions?

International Financial Institutions (IFIs) serve as vital bulwarks supporting developing countries in crisis response and reconstruction, as well as central pillars in global development governance. Unprecedented global challenges such as climate change, the COVID-19 pandemic, and geopolitical conflicts have severely impacted nations worldwide, especially the poorest and most vulnerable populations. With only six years left until 2030, much of the progress towards global sustainable development goals has stagnated or regressed. In the face of intricate global challenges, the capacity of international financial institutions to respond is under unprecedented pressure.

International financial institutions are the core force of global development governance

International financial institutions primarily include the International Monetary Fund (IMF) and Multilateral Development Banks (MDBs). Globally, there are approximately thirty MDBs, including the World Bank Group, regional development banks such as the African Development Bank (AfDB), the Asian Development Bank (ADB), the Inter-American Development Bank (IDB), as well as new MDBs such as the Asian Infrastructure Investment Bank (AIIB).

Major Multilateral Development Banks

|

No. |

Founding |

name |

Headquarters |

|

1 |

1944 |

World Bank (WBG) |

USA |

|

2 |

1956 |

European Commission Development Bank (CEB) |

U.K. |

|

3 |

1958 |

European Investment Bank (EIB) |

Luxembourg |

|

4 |

1959 |

Inter-American Development Bank (IDB) |

USA |

|

5 |

1960 |

Central American Bank for Economic Integration (CABEI) |

Honduras |

|

6 |

1963 |

International Bank for Economic Cooperation (IBEC) |

Russia |

|

7 |

1964 |

African Development Bank (AfDB) |

Ivory Coast |

|

8 |

1966 |

Asian Development Bank (ADB) |

the Philippines |

|

9 |

1967 |

East African Development Bank (EADB) |

Burundi |

|

10 |

1970 |

Caribbean Development Bank (CDB) |

Barbados |

|

11 |

1970 |

Development Bank of Latin America (CAF) |

Venezuela |

|

12 |

1970 |

International Investment Bank (IIB) |

Hungary |

|

13 |

1973 |

West African Development Bank (BOAD) |

Togo |

|

14 |

1974 |

Arab Bank for Economic Development in Africa (BADEA) |

Sudan |

|

15 |

1974 |

Islamic Development Bank (IsDB) |

Saudi Arabia |

|

16 |

1974 |

FONPLATA Development Bank |

Bolivia |

|

17 |

1975 |

ECOWAS Bank for Investment and Development (EBID) |

Togo |

|

18 |

1975 |

Development Bank of Central African States (BDEAC) |

Congo |

|

19 |

1975 |

Nordic Investment Bank (NIB) |

Finland |

|

20 |

1985 |

Trade and Development Bank for Eastern and Southern Africa (TDB) |

Kenya |

|

21 |

1989 |

Pacific Islands Development Bank (PIDB) |

Samoa |

|

22 |

1991 |

European Bank for Reconstruction and Development (EBRD) |

U.K. |

|

23 |

1993 |

African Export-Import Bank (AFREXIMBANK) |

Egypt |

|

24 |

1997 |

Black Sea Trade and Development Bank (BSTDB) |

Greece |

|

25 |

2005 |

OECD Trade and Development Bank (ECOTDB) |

France |

|

26 |

2006 |

Eurasian Development Bank (EDB) |

Kazakhstan |

|

27 |

2014 |

New Development Bank (NDB) |

China |

|

28 |

2015 |

Asian Infrastructure Investment Bank (AIIB) |

China |

(International Development Observer/Table)

International financial institutions are committed to promoting sustainable economic growth.The IMF focuses on fostering international financial stability and sustainable economic growth. Unlike MDBs, the IMF does not provide loans for specific projects but offers financial support to countries in crisis to aid in economic recovery and stability. MDBs play a critical role in global poverty reduction and sustainable growth and development. They provide loans, grants, and technical assistance to developing countries, supporting infrastructure development, education, healthcare, and other sectors to promote economic growth, reduce poverty and inequality, and provide emergency financial support and technical assistance during crises to help low- and middle-income countries overcome challenges.

The main funding for international financial institutions comes from member countries.The IMF's resources come from member countries' quota subscriptions, multilateral and bilateral borrowing arrangements. As of 2023, the IMF's total resources were around 982 billion Special Drawing Rights (SDRs), equivalent to approximately 695 billion SDRs (about 932 billion USD) in lending capacity. The World Bank's funding comes from member countries' capital subscriptions, capital market bond issuances, member country donations, and net income generated from interest payments on loans from the International Bank for Reconstruction and Development (IBRD) and the International Finance Corporation (IFC). In the 2023 fiscal year alone, the World Bank Group provided $128.3 billion in funding to partner countries.

(boell/image)

G7 and G20have a significant impacton the governance and reform of international financial institutions.Significant impact.The Group of Seven (G7) and the Group of Twenty (G20) use their collective influence, financial resources, and policy coordination platforms to advocate for international financial institutions to effectively respond to the evolving needs of the global economy. G7 member countries are the main donor countries for international financial institutions, providing capital, funding support for trust funds and projects, coordinating positions, advocating for and driving specific policies or reforms. The G20 provides a more inclusive platform for member countries to collectively push the IMF and World Bank to focus on key global economic issues, cooperate to promote financial stability, sustainable development, and address challenges such as poverty, inequality, and climate change. In recent years, the G20 has played a central role in driving reforms of international financial institutions to address global challenges.

The private sector, civil society organizations,organizeand other entitiesplay crucial rolesin the governance and operations of international financial institutions.Play an important role.Through consultation mechanisms, the private sector and civil society organizations engage in promoting effective governance within international financial institutions, advocating for more effective, inclusive, and fair policy-making. The private sector, with its expertise, advanced technologies, innovation capabilities, and capital, supports policy-making within international financial institutions, providing technical support for projects, innovative solutions, and project financing. Civil society organizations advocate for improved transparency and disclosure within international financial institutions, ensuring policies and projects adhere to principles of social justice and environmental sustainability, and participate in project implementation.

International financial institutions face unprecedented challenges.

Established in 1944 to support post-World War II reconstruction, the IMF and World Bank have evolved over the years. The number of IMF member countries has increased from dozens to nearly 200, while its total resources have decreased to around 1% of global GDP. Over the decades, international financial institutions have worked to address various challenges, helping billions of people escape poverty and making significant contributions to global sustainable development. In the past five years alone, the World Bank has helped create jobs for 100 million people, expanded healthcare coverage to over 1 billion people, and reduced carbon emissions by over 2.3 billion tons annually. However, global challenges such as climate change, the COVID-19 pandemic, and geopolitical conflicts have led to setbacks in poverty reduction and long-term development processes, exacerbating global poverty and inequality. Low- and middle-income countries face escalating debt burdens, as well as increasing risks to energy and food security. The complex interplay of global challenges highlights the unprecedented challenges faced by international financial institutions.

(AP/Image)

(AP/Image)

Existing institutions are inadequate to address the escalatingglobal challenges.challenge.By 2050, an estimated $125 trillion in climate investments will be needed globally to achieve net-zero emissions targets. However, the World Bank has been criticized for being too conservative in providing loan support to developing countries facing climate challenges. The IMF has also been accused of not doing enough to help countries adapt to climate change, leading to increased debt burdens for poorer nations. During the pandemic, even with support from international financial institutions, low-income countries mobilized only 2% of GDP on average to address the crisis triggered by COVID-19, significantly lower than the 24% average of wealthier countries. The pandemic has led to a significant increase in debt levels in some low- and middle-income countries, with post-pandemic economic growth rates falling far below expectations or sustainable development needs. The 2023 Sustainable Development Financing Report shows that 52 low- and middle-income countries, home to over 40% of the world's extreme poor, are either in debt distress or at high risk of debt distress. The severity of escalating global challenges and the required support far exceed the response capacity of multilateral financial institutions.

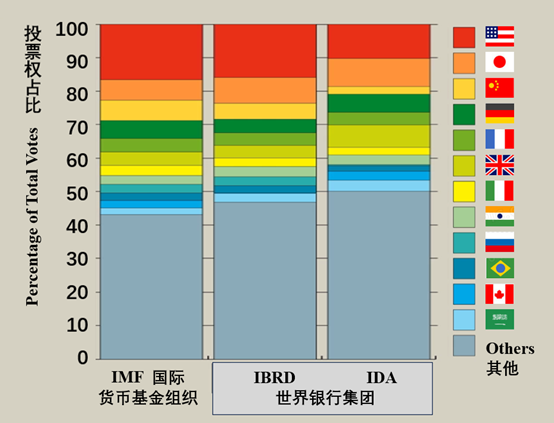

Governance structures fail to reflect the changing needs of developing countries and the global economic landscape.Voting rights at the World Bank and IMF are related to the economic size of each member country. Developed economies hold the majority of voting rights, significantly influencing decision-making within international financial institutions. Developing countries, as major borrowing countries of the World Bank and IMF, have limited influence over the decision-making processes. The rapid rise of emerging economies like China and India in recent decades has not significantly altered this dynamic. High-income countries currently maintain over 60% of voting rights at the IMF, while middle-income countries like India, China, and Brazil hold 32.4% of voting rights, and low-income countries only have 6%. Additionally, the Managing Directors of the IMF and the President of the World Bank are typically held by Europeans and Americans, respectively.

IMF and World Bank Voting Rights (2021) (Global Education Project/Chart)

(Global Education Project/Chart)

Lengthy approval processes and conservative risk preferences hinder efficiency.Multilateral development bank loan projects typically undergo complex and protracted approval processes. Divergent stances and priorities among member countries, beneficiary countries, executive boards, and management make it challenging to efficiently reach consensus on loan project decisions. To ensure the safety and effective use of funds, multilateral development banks rigorously assess and prudently manage project risks, sometimes leading to conservative project selection and decision-making. Furthermore, multilateral development banks strictly adhere to a range of international regulations and internal rules to ensure projects meet environmental, social, and other standards to reduce project risks, but this objectively impacts project approval efficiency and increases the complexity of implementation periods. Overly conservative risk preferences also affect collaboration between multilateral development banks and the private sector.

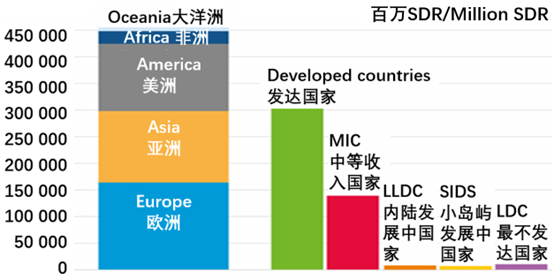

Inadequate support for developing countries.Faced with escalating global challenges, the governance structures of international financial institutions are outdated, their resource mobilization capabilities are limited, approval processes are cumbersome and lengthy, risk preferences are conservative, and as a result, they have not provided sufficient support for developing countries. During the COVID-19 pandemic, it took IMF member countries 17 months to reach an agreement on issuing and allocating $650 billion in new Special Drawing Rights (SDRs). As the distribution of SDRs is based on countries' quota subscriptions, SDRs allocated to developing countries only account for about one-third of the total new SDRs. The African continent, with a population of 1.4 billion and home to over 60% of the world's extreme poor, received only 5.2% of the new SDRs. The least developed countries and small island developing states, facing urgent liquidity needs, received even fewer SDRs.

Global distribution of new Special Drawing Rights in 2021

(UN/Image)

(UN/Image)

Member countries and stakeholders actively promote reforms of international financial institutions.

Major shareholders and borrowing countries are actively pushing for reforms within multilateral development banks and the IMF to accelerate reforms, enhance representation for developing countries, strengthen their capacity to address global development challenges, and play a greater role in tackling global challenges.

Advocating for international financial institutions to take a leading role in addressing global challenges.Member countries are actively pushing for reforming the World Bank's mission and vision, advocating for it to transcend traditional nation-based working methods and prioritize addressing transnational challenges such as climate change and pandemics. Both member and borrowing countries support the World Bank becoming a more robust institution, providing resources at the necessary scale and speed to address global challenges like climate change and meet the urgent needs of the poorest countries. Countries also call on the IMF to play a more significant role in supporting developing countries in addressing debt issues.

(FSIN and Global Network Against Food Crises/Image)

(FSIN and Global Network Against Food Crises/Image)

Increasing representation for developing countries within international financial institutions.Emerging and developing economies believe that governance structures like the boards of directors at the IMF and World Bank must be modernized to reflect the influence of emerging economies and amplify the voices of low- and middle-income countries, making developing countries the protagonists rather than the objects of development cooperation. Leadership positions within international financial institutions should also be open to the most qualified candidates, rather than limited to candidates of a few nationalities.

Urging international financial institutions to safely release more capital to support low- and middle-income countries.Member countries are calling on and urging multilateral development banks like the World Bank to actively leverage their balance sheets to release billions of dollars in new loans. Developed countries and major economies should also provide new concessional financing to multilateral development banks, supporting them in providing more resources under more favorable conditions in the future and assisting countries in implementing reform and development projects to address global challenges. Additionally, many member countries support channeling unused IMF SDRs to countries at risk and in need of liquidity support to help prevent liquidity tightening from evolving into a debt crisis. The IMF should also relax restrictions on the use of its rapid financing instruments and suspend surcharges on heavily indebted borrowers when necessary.

Calling for international financial institutions to improve efficiency, mobilize private capital, and enhance collaboration.Borrowing countries are calling on multilateral development banks to improve efficiency, accelerate the deployment and approval of loan projects, and shorten funding disbursement periods. Member countries believe that multilateral development banks should fully utilize the funds and expertise of the private sector, attract more private sector investments, and enhance collaboration with the private sector. There should also be increased cooperation between different multilateral development banks, promoting innovative financing and reducing project risks. Furthermore, platforms like the Global Alliance for Vaccines and Immunization (Gavi) should be utilized to expand opportunities for low- and middle-income countries to access public goods and promote the fair distribution of technologies like renewable energy.

With efforts from major shareholders and borrowing countries, the international community has reached broad consensus through platforms like the G20 and mechanisms, resulting in reports, initiatives, or agendas that drive reform within international financial institutions.

The MultilateralCapital Adequacy Framework for Border Development BanksReport recommends releasing more capital within multilateral development banks.In July 2022, an expert group commissioned by the G20 released the Multilateral Development Bank Capital Adequacy Framework (CAF) report, proposing five strategic shifts to maximize the capital impact of multilateral development banks. The report suggests that through "extremely controlled changes in risk-bearing capacity," multilateral development banks like the World Bank can increase lending by trillions of dollars in the medium term while maintaining AAA credit ratings and borrowing on favorable terms in capital markets.

《The Bridgetown Initiativecalls for a comprehensive reform of global development finance and has garnered widespread support.In November 2022, Barbados Prime Minister Mottley launched the Bridgetown Initiative, proposing a reform of global development finance where wealthy countries assist low- and middle-income countries in addressing climate change. The initiative suggests changing loan and repayment terms to prevent developing countries from falling into debt crises due to consecutive disasters like floods and droughts; demands additional lending of $1 trillion from multilateral development banks to support developing countries in enhancing climate resilience; and proposes establishing new mechanisms to provide funding for post-disaster climate mitigation and reconstruction. The initiative has been highly endorsed by French President Macron, IMF Managing Director Georgieva, and others.

(AP/Image)

(AP/Image)

"Our Common Agenda: Reforming the International Financial Institutions" proposes reforming the international financial system.Our Common Agenda: Reforming International Financial Institutions proposes reforming the international financial system. In May 2023, the United Nations' Our Common Agenda: Reforming International Financial Institutions report suggested reforming governance and decision-making rules within international financial institutions to reflect the evolving global landscape and grant more voice to developing countries, significantly increasing the scale of loans and improving loan terms to support challenges like climate change, changing the business model of multilateral development banks, and effectively utilizing private sustainable finance.

Strengthening the Multilateral Development Banks:G20 Independent Experts Group's Triple Agenda Reportby the G20 Independent Expert Group recommends reforming multilateral development banks to unlock their potential.In June 2023, this independent expert report commissioned by the G20 India Summit proposed a triple agenda for reforming multilateral development banks. The agenda includes eliminating extreme poverty, promoting shared prosperity, and advancing global public goods as the three major tasks. By 2030, sustainable lending levels are expected to double. The report suggests establishing a third financing mechanism that allows for flexible and innovative arrangements to engage with investors willing to support the agendas of multilateral development banks.

Positive Progress have been made in International Financial Institution Reforms

Since their establishment in 1944, the World Bank and IMF have repeatedly adjusted their missions and goals to address evolving development challenges, from initially supporting post-World War II European reconstruction to transitioning in 2013 towards eradicating extreme poverty and promoting shared prosperity. In recent years, the IMF has made several adjustments to its quota allocations to enhance representation for emerging economies. With increasing pressure from member countries, borrowing countries, and other stakeholders to reform international financial institutions, significant progress was achieved in World Bank and IMF reforms in 2023.

(Morocco Ministry of Finance/Image)

(Morocco Ministry of Finance/Image)

The World Bank's reform focuses on addressing global challenges, expanding financial capacity, improving efficiency, and strengthening collaboration with the private sector.In October 2023, the World Bank unveiled a new development vision and action plan, marking significant progress in the Evolution Roadmap initiated in 2022. The World Bank has redefined its vision to create a world without poverty on a livable planet, emphasizing the integration of global challenges into the core responsibilities of the institution while maintaining a long-term focus on poverty and inclusive growth. The World Bank has proposed financial policy reforms, such as issuing hybrid capital, reforming guarantee mechanisms, and adjusting loan-to-equity ratios, using innovative tools to provide an additional $157 billion in lending capacity over ten years. The World Bank will identify barriers to investment in emerging markets and potential solutions, expand and mobilize innovative tools, attract more private sector investment, and enhance cooperation with the private sector. The World Bank will reform its operational model, reduce bureaucracy without compromising standards, streamline norms and procedures to enhance efficiency, expand impact, and improve its ability to effectively engage and address regional and global challenges. Reforms in other multilateral development banks have also made positive progress. The African Development Bank proposed funding hybrid capital through redistributed SDRs. The Asian Development Bank launched the Asia-Pacific Regional Innovation Fund and announced the expansion of its balance sheet to unlock new funds.

The IMF approved the quota increase and called for further adjustments to quota allocations.In December 2023, the IMF Board of Governors completed the 16th General Review of Quotas, approving a 50% increase in member country quotas (equivalent to 238.6 billion Special Drawing Rights, or about 320 billion USD), while reducing reliance on borrowed resources. This move is expected to maintain the IMF's current lending capacity and strengthen its ability to maintain global financial stability and meet potential member country needs. Member countries are expected to approve their quota increases by November 15, 2024. Meanwhile, the IMF Board called for guidance methods for further quota adjustments to be proposed by June 2025, to be used in the 17th General Review of Quotas to better reflect the relative positions of each member country in the global economy, while also safeguarding the quota shares of the poorest member countries.

The effectiveness and prospects of international financial institutions reform.

The significant progress in the reform of international financial institutions has been facilitated by a broad international consensus.Reports such as the "Multilateral Development Bank Capital Adequacy Framework Report" and "Strengthening Multilateral Development Banks: The Triple Agenda Report of the G20 Independent Expert Group," along with initiatives like the "Bridgetown Initiative" proposed by Barbados and the United Nations' "Our Common Agenda: Reforming International Financial Institutions," have each provided recommendations on the reform of international financial institutions from the perspectives of advanced and middle-income economies, developing countries, and the United Nations. These efforts underscore the widespread consensus among key stakeholders on the necessity and urgency of reforming international financial institutions. Driven by this momentum, the World Bank's Annual Meetings in autumn 2023 endorsed reform proposals and incorporated key recommendations from the G20 reports and the "Bridgetown Initiative." This development signifies significant and positive strides in the reform of international financial institutions.

The effects and impacts of international financial institution reforms are still to be observed.While the World Bank's reform plan has garnered support from many countries, the specific details and actions of support from major countries, the amounts of financing, and the conditions are yet to be fully realized, and many reform measures have not yet entered the implementation stage. Moreover, the reforms challenge the traditional business model of the World Bank, and the extent to which it can change deeply entrenched bureaucratic institutions remains a challenge. The next round of IMF quota adjustments will also face political and diplomatic challenges. Therefore, the effects and impacts of this round of international financial institution reforms will require longer evaluation.

The success of international financial institution reforms depends on the support of developed countries and major economies.The support of developed countries and major economies, which hold the main voting rights at the World Bank and IMF, will determine the success or failure of reforms within international financial institutions. The ability of developed countries and major economies to provide new funding to the World Bank's IBRD and significant financial resources to the International Development Association (IDA) will largely determine how much additional lending the World Bank can provide and the extra support it can offer to developing countries urgently needing to adapt to climate change. If sufficient and effective financial support is not obtained, the World Bank's reform efforts may come to naught. The next round of IMF quota reviews plans to adjust the share of each country's quotas. Increasing the share of emerging economies and protecting the share of poor countries will come at the expense of reducing the share of developed countries. The extent to which this can gain political support from relevant countries remains uncertain.

(AFP/Photo)

(AFP/Photo)

The United Nations Sustainable Development Goals (SDGs) are set to expire in 2030. Driving effective reforms in international financial institutions is crucial for rebuilding trust in multilateralism among nations, advancing the post-2030 agenda, and constructing a more prosperous, equitable, livable, and peaceful twenty-first century. Reforming international financial institutions necessitates diplomatic agreements among member countries on agendas such as enhancing the voice of developing countries and promoting the provision of global public goods. This process must fully consider and adapt to the diversity and complexity of national preferences and circumstances. However, escalating geopolitical tensions, divergent national interests, and domestic political agendas pose increased challenges for countries to reach consensus on rebuilding the international financial order. Continuation of institutional inertia will only strengthen the resolve of emerging economies to seek alternative "small edge" initiatives. The upcoming 2024 World Bank and International Monetary Fund Annual Meetings, United Nations Future Summit, and G20 Brazil Summit have all placed international financial institution reform high on their agendas. Expectations are high for positive progress in the reform agenda to collectively address global challenges and promote growth, employment, and prosperity worldwide.

(Snpedro Sun/main image)

References

https://press.un.org/en/2023/ecosoc7118.doc.htm

https://www.shihang.org/zh/who-we-are

https://www.imf.org/zh/About/Factsheets/Where-the-IMF-Gets-Its-Money

https://www.imf.org/zh/About/Factsheets/Sheets/2022/How-the-IMF-makes-decisions

https://www.cgdev.org/blog/introducing-mdb-reform-tracker

https://www.cgdev.org/publication/abcs-ifis-understanding-world-bank-group-evolution

https://www.cgdev.org/blog/introducing-mdb-reform-tracker

https://www.cgdev.org/blog/world-bank-reform-landing-tiger-or-housecat

https://www.weforum.org/agenda/2023/01/barbados-bridgetown-initiative-climate-change/

https://sdg.iisd.org/news/ministers-set-out-priorities-for-2024-summit-of-the-future/

https://www.wri.org/technical-perspectives/mdb-reform-climate-sustainable-development

https://mp.weixin.qq.com/s/82EbLcVeoYXOfYBk_iovPA

https://www.theglobaleducationproject.org/earth/development/voting-control-of-the-imf-and-world-bank

https://www.ft.com/content/4e974d8f-80c8-4ab6-a6d8-597e979787ba\

https://www.nytimes.com/2023/02/23/business/world-bank-president-nomination.html

https://www.nytimes.com/2023/12/08/business/cop28-world-bank-ajay-banga.html

All rights reserved, please indicate the source when citing.